Throughout American history, worker unions have played a significant role in shaping labor conditions, workers’ rights, and the overall economic landscape of the country. There have been periods when these unions gained substantial negotiating power and enjoyed widespread public support, often at the expense of employers. This article explores some of these historical periods when worker unions reached the zenith of their influence and how these conditions affected stock markets.

The Labor Movement in the Late 19th Century

The late 19th century marked the emergence of labor unions as a force to be reckoned with in the United States. As industrialization swept the nation, workers faced long hours, dismal working conditions, and meager wages. The rise of labor unions during this period was largely a response to these unfavorable conditions. Organizations such as the American Federation of Labor (AFL) and the Knights of Labor gained traction, demanding better wages, improved workplace safety, and shorter workdays.

By the late 1800s, these labor unions had amassed significant negotiating power. Strikes and labor disputes became commonplace, with workers often winning concessions from employers. The Haymarket affair of 1886, the Pullman Strike of 1894, and other labor disputes during this era showcased the growing influence of unions.

Impact on Stock Markets: The stock markets of the late 19th century were relatively young and less interconnected with labor issues compared to today. While specific data on stock market performance during this period is limited, it is safe to assume that the strikes and labor unrest of the time may have caused market fluctuations. The uncertainty created by labor disputes could have affected investor confidence and contributed to short-term market volatility.

The Great Depression and the New Deal

The stock market crash of 1929 and the subsequent Great Depression dramatically altered the landscape for both workers and employers in the United States. During the early 1930s, unemployment soared, and many workers were left destitute. This period marked the rise of labor unions’ political power, notably the Congress of Industrial Organizations (CIO), which advocated for the rights of industrial workers.

The New Deal, a series of economic policies implemented by President Franklin D. Roosevelt, included several provisions aimed at empowering labor unions and improving workers’ conditions. The National Labor Relations Act (NLRA) of 1935, also known as the Wagner Act, allowed workers to organize and bargain collectively with their employers. This marked a significant turning point for the labor movement, as it provided legal protection for union activities.

Impact on Stock Markets: The stock market had already been severely affected by the Great Depression, so the rise of labor unions and the New Deal policies were part of a broader effort to stabilize the economy. While these policies may have added some uncertainty for investors, they were also seen as a means to address the economic crisis. The stock market’s recovery was gradual, and various factors contributed to its improvement, including government intervention in the form of the New Deal.

The Post-War Boom and the Labor Movement

After World War II, the United States experienced a period of unprecedented economic growth and prosperity. This era, often referred to as the post-war boom, saw the emergence of powerful labor unions, including the United Auto Workers (UAW), the United Steelworkers (USW), and the International Brotherhood of Teamsters.

The labor movement played a significant role in securing better wages and benefits for workers during this period. Collective bargaining agreements often included generous health benefits, pensions, and cost-of-living adjustments. Unions also pushed for workplace safety regulations, which improved conditions for millions of workers.

Impact on Stock Markets: The post-war boom was characterized by strong economic growth and a rising stock market. While labor unions secured significant concessions for their members, the overall economic environment was conducive to stock market growth. Investors benefited from the prosperity brought about by increased consumer spending and industrial expansion. As a result, the influence of labor unions during this period did not have a detrimental effect on stock markets, which continued to perform well.

The Decline of Labor Unions in the Late 20th Century

Despite their successes in the post-war era, labor unions began to face challenges in the late 20th century. Several factors contributed to their decline, including increased automation, globalization, and changing attitudes toward unions. The decline in union membership and power was particularly pronounced in the private sector.

One significant event was the 1981 air traffic controllers’ strike, in which President Ronald Reagan fired over 11,000 striking controllers, effectively breaking the union. This action sent a clear message to labor unions that strikes could have dire consequences.

Impact on Stock Markets: The decline of labor unions in the late 20th century coincided with a period of stock market growth. The stock market experienced significant expansion during the 1980s and 1990s, partly driven by deregulation, technological advancements, and increased international trade. The reduced influence of labor unions did not appear to have a negative impact on stock markets during this period.

The 21st Century Labor Movement

In the 21st century, labor unions have faced ongoing challenges. Union membership, especially in the private sector, has continued to decline. However, public-sector unions, such as those representing teachers and government workers, have remained influential.

One of the most significant labor movements in recent history was the Fight for $15 campaign, which aimed to raise the minimum wage to $15 per hour. This movement gained widespread public support and saw success in several states and cities, leading to higher minimum wages. It also reignited conversations about workers’ rights and income inequality.

Impact on Stock Markets: The impact of 21st-century labor movements on stock markets has been limited, as these movements have often focused on specific industries or labor practices rather than broad-based economic policies. While there may be short-term effects on specific companies or sectors affected by labor actions, the overall impact on stock markets from labor disputes has been relatively muted.

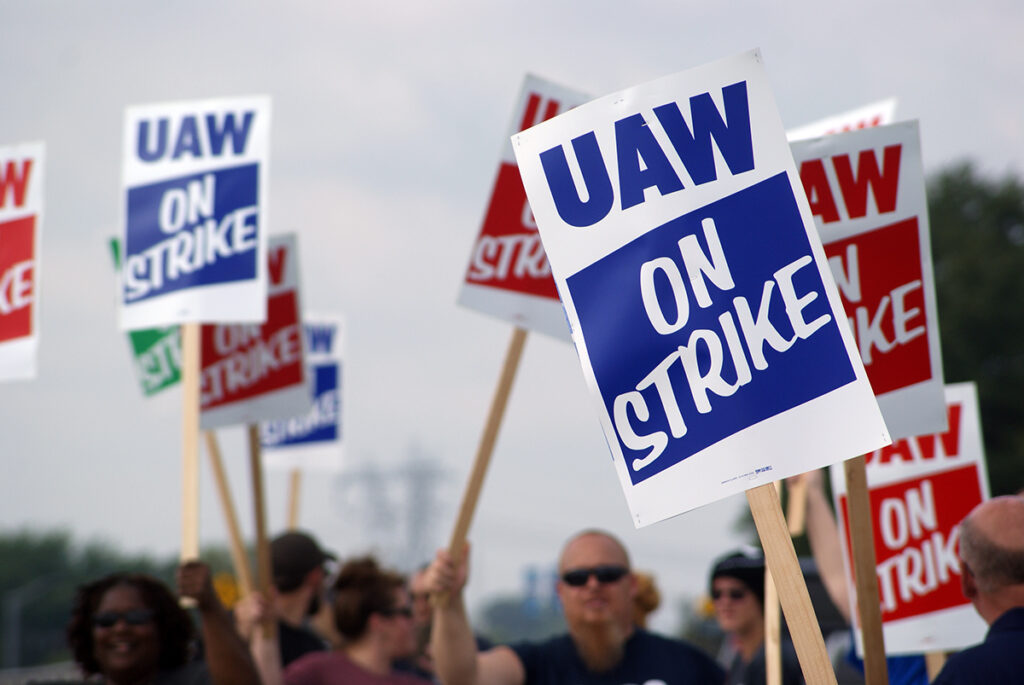

The Hot Labor Summer of 2023

The Hot Labor Summer of 2023 has brought worker unions to the forefront of national discussions. Workers across various industries are rallying for improved wages, safer working conditions, and a fair share of the economic prosperity they help generate. The resurgence of labor unions and the growing public support for workers’ rights reflect a broader societal shift toward greater economic equality and fair labor practices.

This resurgence in worker activism has its roots in historical labor movements, where unions played pivotal roles in advancing the interests of workers. Now, as we delve into the current labor landscape, it’s crucial to examine both the short-term consequences of union activities on stock markets and the long-term economic benefits of ensuring workers’ well-being.

The Impact of Worker Unions on Stock Markets

Historically, stock markets have often reacted negatively to union strikes and strong labor negotiations. These actions can create uncertainty for investors and disrupt the normal functioning of businesses. Stock prices may temporarily dip as a result of labor-related turmoil. However, it’s essential to recognize that these short-term market fluctuations do not necessarily reflect the overall economic health and sustainability.

Numerous economists and scholars have examined the relationship between labor unions, stock markets, and the broader economy. Research by economists like Richard B. Freeman, Lawrence Mishel, and Heidi Shierholz suggests that while labor actions may trigger short-term market turbulence, the long-term effects of providing adequate pay and working conditions can significantly boost the economy.

What Research Says: Long-Term Economic Benefits of Workers’ Rights

a. Increased Consumer Spending: When workers earn higher wages and have better working conditions, they are more likely to spend their income, stimulating consumer spending. This increased demand for goods and services can fuel economic growth and benefit various industries. Economists have pointed to the positive correlation between higher wages and consumer spending as a driver of economic prosperity.

b. Improved Productivity: Fair compensation and safe working environments can lead to a more motivated and productive workforce. When employees feel valued and secure, they tend to work more efficiently, contributing to increased output and profitability for businesses. Research by David Card and Alan Krueger on the impact of a minimum wage increase in New Jersey provides evidence of how improved working conditions can enhance productivity.

c. Reduced Income Inequality: Labor unions have historically played a role in reducing income inequality by advocating for fair wages and benefits for all workers. A more equitable distribution of wealth can lead to greater social and economic stability. Economist Thomas Piketty’s research on income inequality highlights the importance of addressing this issue for long-term economic health.

d. Enhanced Job Satisfaction and Retention: Improved working conditions and better compensation can lead to higher job satisfaction and reduced turnover rates among employees. This stability benefits both workers and employers, as recruiting and training new employees can be costly and disruptive to businesses.

e. Strengthened Human Capital: A workforce that receives proper training, education, and support is better equipped to adapt to changing industries and technological advancements. Investment in human capital, which includes worker training and development, is essential for long-term economic growth, as emphasized by Nobel laureate Gary Becker.

The Hot Labor Summer of 2023 marks a significant resurgence in worker’s rights activism and union popularity in the United States. While it’s true that stock markets may react negatively to union strikes and strong negotiations in the short term, the long-term economic benefits of providing workers with fair pay and better working conditions are well-documented in economic research.

Economists have consistently found that improving workers’ well-being positively impacts the economy by stimulating consumer spending, enhancing productivity, reducing income inequality, increasing job satisfaction and retention, and strengthening human capital. As the United States navigates this new era of worker’s rights activism, it’s essential to consider the broader economic implications and recognize that securing workers’ rights can be a catalyst for sustainable economic growth and prosperity for all.